Things You Cannot Do In Nigeria Without A Tax Clearance Certificate. Daily Law Tips (Tip 373) by Onyekachi Umah, Esq., LLM. ACIArb(UK)

Tax is revenue for government and government must ensure tax payers comply and pay adequate tax. By law, government ministries, departments, agencies, parastatals and establishment or commercial bank while dealing with any person must demand from the person a valid tax clearance certificate and also verify the genuineness of same by referring it to the issuing tax office.

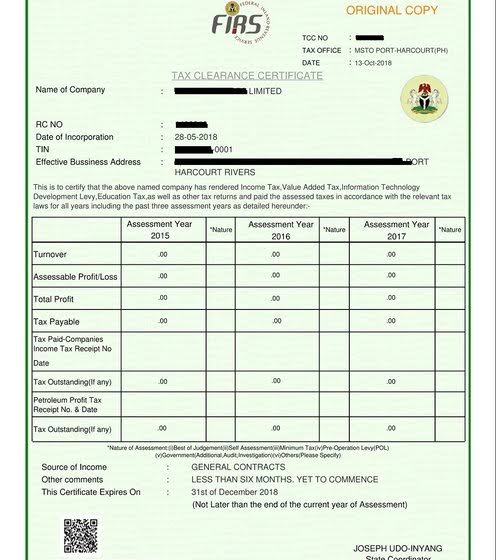

Below is a list of things/transactions you cannot do/conduct in Nigeria without a tax clearance certificate:

(a) application for Government loan for industry or business;

(b) registration of motor vehicle;

(c) application for firearms licence;

(d) application for foreign exchange or exchange control permission to remit funds outside Nigeria;

(e) application for certificate of occupancy;

(f) application for award of contracts by Government, its agencies and registered companies;

(g) application for approval of building plans;

(h) application for trade licence;

(i) application for transfer of real property;

(j) application for import or export licence;

(k) application for agent licence;

(l) application for pools or gaming licence;

(m) application for registration as a contractor;

(n) application for distributorship;

(o) confirmation of appointment by Government as chairman or member of a public board, institution, commission, company or to any other similar position made by the Government;

(p) stamping of guarantor’s form for a Nigerian passport;

(q) application for registration of a limited liability company or of a business name;

(r) application for allocation of market stalls;

(s) appointment or election into public office.

(t) for change of ownership of vehicle by the vendor;

(u) application for plot of land; and

(v) any other transaction as may be determined from time to time.

(w) application for control permission to remit funds abroad to a non-resident from rent, dividends, interest, royalty and fee, etc.

Note that failure of government organisation or commercial bank to demand and obtain tax clearance certificate of a person before relating with such person on the above listed issues has committed an offence and it is punishable with fine of 5 Million Naira and or imprisonment for 3 years.

Reference:

Sections 1, 2, 3, 85, 108 and 109 of the Personal Income Tax Act 1993.

#DailyLawTips

#SabiLaw

#LearnNigerianLaws

Feel free to reach the author, ask questions or make inquiries on this topic or any other legal issues via onyekachi.umah@gmail.com or +2348037665878.

****************************************************************************************

This work is published under the free legal awareness project of Sabi Law Foundation (www.SabiLaw.org) funded by the law firm of Bezaleel Chambers International (www.BezaleelChambers.com). The writer was not paid or charged any publishing fee. You too can support the legal awareness projects and programs of Sabi Law Foundation by donating to us. Donate here and get our unique appreciation certificate or memento.

DISCLAIMER:

This publication is not a piece of legal advice. The opinion expressed in this publication is that of the author(s) and not necessarily the opinion of our organisation, staff and partners.

PROJECTS:

🛒 Take short courses, get samples/precedents and learn your rights at www.SabiLaw.org

🎯 Publish your legal articles for FREE by sending to: eve@sabilaw.org

🎁 Receive our free Daily Law Tips & other publications via our website and social media accounts or join our free whatsapp group: Daily Law Tips Group 6

KEEP IN TOUCH:

Get updates on all the free legal awareness projects of Sabi Law (#SabiLaw) and its partners, via:

YouTube: SabiLaw

Twitter: @Sabi_Law

Facebook page: SabiLaw

Instagram: @SabiLaw.org_

WhatsApp Group: Free Daily Law Tips Group 6

Telegram Group: Free Daily Law Tips Group

Facebook group: SabiLaw

Email: lisa@sabilaw.org

Website: www.SabiLaw.org

ABOUT US & OUR PARTNERS:

This publication is the initiative of the Sabi Law Foundation (www.SabiLaw.org) funded by the law firm of Bezaleel Chambers International (www.BezaleelChambers.com). Sabi Law Foundation is a Not-For-Profit and Non-Governmental Legal Awareness Organization based in Nigeria. It is the first of its kind and has been promoting free legal awareness since 2010.

DONATION & SPONSORSHIP:

As a registered not-for-profit and non-governmental organisation, Sabi Law Foundation relies on donations and sponsorships to promote free legal awareness across Nigeria and the world. With a vast followership across the globe, your donations will assist us to increase legal awareness, improve access to justice, reduce common legal disputes and crimes in Nigeria. Make your donations to us here or contact us for sponsorship and partnership, via: lisa@SabiLaw.org or +234 903 913 1200.

**********************************************************************************

One Response