A Guarantor/ Surety And A Witness Are Not Same. Daily Law Tips (Tip 567) by Onyekachi Umah, Esq., LLM. ACIArb(UK)

At workplaces, clubs, religious centers and reunions, friends and family members often request for Guarantor’s forms to be signed. Well, only few people read through such prolix (often long annoying terms and conditions) while very few seek legal advice before signing such documents. In whatever you sign, note there is a huge difference between a Guarantor and a Witness. The gap is so wide that in one, a person os a mere spectator and in the other the person being led to a slaughter slab.

A witness to an agreement is a person that was chosen by all parties or a party to an agreement, for such chosen person to be present at the making of an agreement by parties and such chosen party was indeed present. A witnesses attests and confirms that truly an agreement was made between parties concerned. In customary/traditional and oral transactions, witnesses are compulsory. For instance, in most traditions in Nigeria, a witnesses must be present for a customary land transaction to be valid. In written agreements, witnesses are deemed to be proper witnesses and present when they attest and subscribe (sign or affix their marks) to the concerned agreement, attesting to their presence at the time of the making of the agreement. Note that unlike most written agreements that may not require a witness for them to be valid, a “WILL” must have at least two witnesses for it to be valid. Colloquially, a witness is referred to as “Eyes We See” (the eyes that have seen or that saw). There is no standard set of words or clauses for attestation or witnessing an agreement. There is no legal liability in being a witnesses to an agreement. A witness must be truthful at all times and be bold to give a true account and testimony (evidence) of what transpired in an agreement that he witnessed, even in a court of law. Witness is a mere spectator to an agreement.

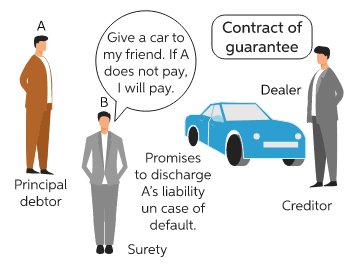

A guarantor is a person that has brought out himself, to stand and take over certain liabilities of another person, if such other person fails to take over the said liabilities. A guarantor is a “Mr. A” that tells “Mr. B” not to worry about a risk or debt owed to “Mr. B” by “Mr. C” and further agrees to pay such debt that “Mr. C” owes “Mr. B”. Allegorically, a guarantor is like the good Sameritian of the good book that picked up a wounded man, took him to the hospital and paid his bills. A Guarantor is also known as Surety, Secondary Debtor or Undertaker, who agrees to takeover and pay the debts of a third party known as Principal Debtor to a Creditor, once such Principal Debtor fails to pay the Creditor. So, the liabilities of a Principal Debtor is automatically that of a Guarantor once a Principal Debtor fails to pay a Creditor. In some cases, the Guarantor even undertakes to pay debt directly without giving the Creditor an opportunity to recover such from the Principal Debtor; thereby fully absorbing the Principle Debtor and replacing the Principal Debtor with himself (Guarantor) as the Principal Debtor.

Below are the clear words of Supreme Court’s Justices on this issue:

“The above position of the law becomes clearer when one understands what a guarantee is. The term has been defined as a written undertaking made by one person to another to be responsible to that other if a third person fails to perform a certain duty e.g. payment of debt. Thus where a borrower (i.e. the third party) fails to pay an outstanding debt, the guarantor (or surety as he is sometimes called) becomes liable for the said debt.”

Per WALTER SAMUEL NKANU ONNOGHEN ,J.S.C ( P. 32, paras. B-D). Quote from the judgment in case of CHAMI v. UBA PLC (2010) LPELR-841(SC)

“Once again, by way of emphasis and this is also settled, the liability of a/the guarantor, becomes due and mature, immediately the debtor/borrower, becomes unable to pay its/his outstanding debt. The guarantor’s liability, is then said to have, crystallized. See Royal Exchange Assurance (Nig.) Ltd. v. Aswani Textiles Ltd. (1992) NWLR (Pt.227)1; (1992) 2 SCNJ 346; Eboni Finance & Securities Ltd. v. Wole-Ojo Technical Services Ltd. & 2 Ors.(1996) 7 NWLR (Pt.461) 464 at 476 C.A.; Salawal Motor House Ltd. & Anor. v. Hajji B. Lawal & Anor. (1999) 9 NWLR (Pt. 620) 692, at 706, C.A.”

Per IKECHI FRANCIS OGBUAGU ,J.S.C ( Pp. 90-91, paras. E-A ). Quote from the judgement in the case for of AUTO IMPORT EXPORT v. ADEBAYO & ORS (2005) LPELR-642(SC)

“it is settled law that where a person personally guarantees the liability of a third party by entering into a contract of guarantee or suretyship, a distinct and separate contract from the principal debtor’s is thereby created between the guarantor and the creditor. The contract of guarantee so created can be enforced against the guarantor directly or independently without the necessity of joining the principal debtor in the proceedings to enforce same – see Olujitan vs Oshatoba (1992) 5 NWLR (pt. 241) 326 at 329; Ekerebe vs Efeizorma II (1993) 7 NWLR (pt. 307) 588 at 601. In Chitty on Contract, 24th Ed. Vol. 2 paragraph 4831, the law is stated thus:- “…..prima facie the surety may be proceeded against without demand against him, and without first proceeding against the principal debtor.” See also Moschi vs Lep Air Service Ltd (1973) AC 331 at 348; Esso Pet C. Ltd VS Alastonbridge Properties (1975) WLR 1474.”

Per WALTER SAMUEL NKANU ONNOGHEN ,J.S.C ( Pp. 31-32, paras. C-A ). Quote from the judgment in the case of CHAMI v. UBA PLC (2010) LPELR-841(SC)

In matters of guarantee of this nature, there is sometimes the need to recognize the three parties, namely: the creditor, the principal debtor and the secondary debtor or guarantor. Either of two situations could thus arise. One is that the guarantor may not primarily undertake to discharge the liability but only if the principal debtor failed in his obligation. There is the other situation where a person by his undertaking makes himself the real debtor: see Birkmyr v. Darnell (1704) 1 Salkeld 27, (1704) 91 ER 27. In the first case, the principal debtor has to default before the liability of the guarantor would arise. In the second case, the principal debtor simply drops out so that the guarantor becomes solely liable.

Per SAMSON ODEMWINGIE UWAIFO ,J.S.C ( Pp. 15-16, paras. C-D ). Quote from the judgment in the case of FORTUNE INTERNATIONAL BANK PLC v. PEGASUS TRADING OFFICE (GMBH) & ORS (2004) LPELR-1288(SC)

References:

1. The Supreme Court’s decision (on guarantorship) in the case of INSTITUTE OF HEALTH ABU HOSPITAL MANAGEMENT BOARD v. ANYIP (2011) LPELR-1517(SC)

2. The Supreme Court’s decision (on guarantorship) in the case of FORTUNE INTERNATIONAL BANK PLC v. PEGASUS TRADING OFFICE (GMBH) & ORS (2004) LPELR-1288(SC)

3. The Supreme Court’s decision (on guarantorship) in the case of AUTO IMPORT EXPORT v. ADEBAYO & ORS (2005) LPELR-642(SC)

4. The Supreme Court’s decision (on guarantorship) in the case of CHAMI v. UBA PLC (2010) LPELR-841(SC)

5. The Court of Appeal’s judgment (on the role of witnesses to a WILL) in the case of IYAMU v. ALONGE (2007) LPELR-8689(CA)

#SabiLaw

#DailyLawTips

#SabiBusinessLaw

#SabiElectionLaws

#SabiHumanRights

#SabiLawOnBeatFm

#SabiLawLectureSeries

#CriminalJusticeMonday

#SabiLawVideoChallenge

Feel free to reach the author, ask questions or make inquiries on this topic or any other legal issues via onyekachi.umah@gmail.com or +2348037665878.

****************************************************************************************

This work is published under the free legal awareness project of Sabi Law Foundation (www.SabiLaw.org) funded by the law firm of Bezaleel Chambers International (www.BezaleelChambers.com). The writer was not paid or charged any publishing fee. You too can support the legal awareness projects and programs of Sabi Law Foundation by donating to us. Donate here and get our unique appreciation certificate or memento.

DISCLAIMER:

This publication is not a piece of legal advice. The opinion expressed in this publication is that of the author(s) and not necessarily the opinion of our organisation, staff and partners.

PROJECTS:

🛒 Take short courses, get samples/precedents and learn your rights at www.SabiLaw.org

🎯 Publish your legal articles for FREE by sending to: eve@sabilaw.org

🎁 Receive our free Daily Law Tips & other publications via our website and social media accounts or join our free whatsapp group: Daily Law Tips Group 6

KEEP IN TOUCH:

Get updates on all the free legal awareness projects of Sabi Law (#SabiLaw) and its partners, via:

YouTube: SabiLaw

Twitter: @Sabi_Law

Facebook page: SabiLaw

Instagram: @SabiLaw.org_

WhatsApp Group: Free Daily Law Tips Group 6

Telegram Group: Free Daily Law Tips Group

Facebook group: SabiLaw

Email: lisa@sabilaw.org

Website: www.SabiLaw.org

ABOUT US & OUR PARTNERS:

This publication is the initiative of the Sabi Law Foundation (www.SabiLaw.org) funded by the law firm of Bezaleel Chambers International (www.BezaleelChambers.com). Sabi Law Foundation is a Not-For-Profit and Non-Governmental Legal Awareness Organization based in Nigeria. It is the first of its kind and has been promoting free legal awareness since 2010.

DONATION & SPONSORSHIP:

As a registered not-for-profit and non-governmental organisation, Sabi Law Foundation relies on donations and sponsorships to promote free legal awareness across Nigeria and the world. With a vast followership across the globe, your donations will assist us to increase legal awareness, improve access to justice, reduce common legal disputes and crimes in Nigeria. Make your donations to us here or contact us for sponsorship and partnership, via: lisa@SabiLaw.org or +234 903 913 1200.

**********************************************************************************

3 Responses

Thanks for bringing contemporary legal issues in readable and easy to grasp way.

Kudos