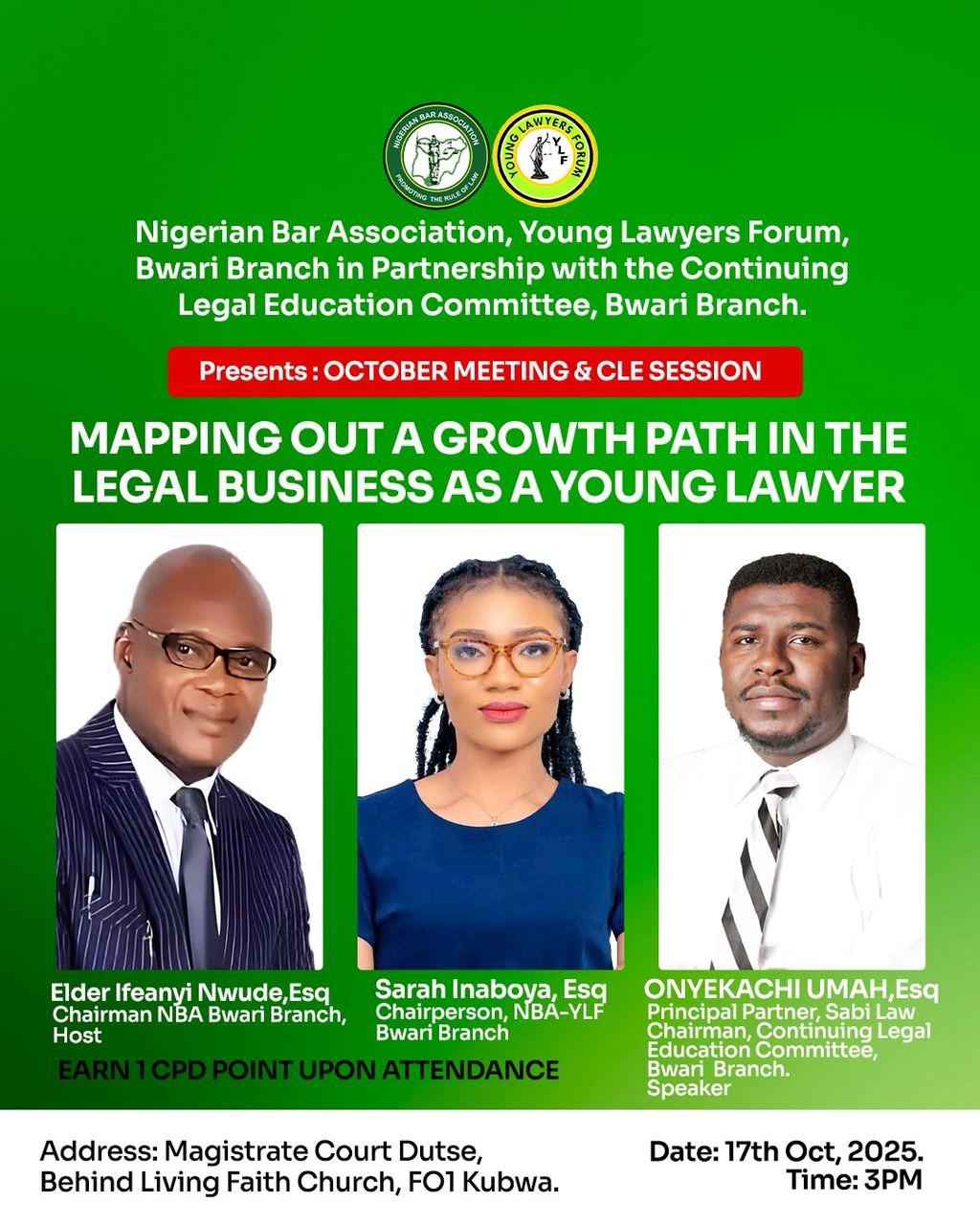

Again, the EFCC Lacks Power Over Lawyers Bank Accounts. Daily Law Tips (Tip 815) by Onyekachi Umah, Esq., LL.M, ACIArb(UK)

Introduction:

It is no news that Nigerians are greatly talented and that some have invested their talents in financial crimes. To better combat the rise in economic and financial crimes in Nigeria, the Federal Government of Nigeria instituted the Economic and Financial Crimes Commission (EFCC). Aside the creation of institutions, the Federal Government also enacted robust legislatures to fight financial crimes across Nigeria.

Since fraudulent persons in Nigeria launder money through bank accounts of or transactions involving some religious centers, Not-For-Profits organizations, property and estate firms, travels, luxury and life style companies, legal practitioners, stock brokers and others, supervising such accounts have become inevitable. Hence, there are federal laws (Money Laundering (Prohibition) Act 2011 and the Terrorism (Prevention) Act 2011) that allow EFCC to supervise such bank accounts. However, legal practitioners have frowned at parts of such laws (particularly the Money Laundering (Prohibition) Act 2011) and labeled it; a violation of earlier existing federal laws (the Evidence Act and the Constitution of Nigeria) and the Client-Attorney Relationship.

Legal practitioners in Nigeria (through the professional body; the Nigerian Bar Association) challenged the Federal Government of Nigeria in courts, contesting that a lawyer’s bank should not be supervised. Judgment was given in favour of legal practitioners at the High Court and at the Court of Appeal. However, recently, on 14 May 2021, the Court of Appeal had another opportunity to rule on this issue, in a case between FEDERAL REPUBLIC OF NIGERIA and CHIEF MIKE OZEKHOME (SAN).

This work reiterates the recent position of the Court of Appeal on whether the EFCC truly lacks power over the bank accounts of lawyers (ie, Client accounts kept by lawyers). It analyzes the interactions between the EFCC, the SCMUL and the Legal Practitioners in Nigeria. It attempts to x-ray the cold war between legal practitioners in Nigeria and the EFCC, due to the clash between the Money Laundering (Prohibition) Act 2011 and the Evidence Act, 2011. It summarizes the three (3) judgments of the Nigerian Courts on whether the Money Laundering (Prohibition) Act 2011 applies to Lawyers. It concludes with an actionable advice to the EFCC on ways to stop and prevent financial crimes involving lawyers and their clients.

The EFCC, the SCMUL and the Legal Practitioners in Nigeria:

The Money Laundering (Prohibition) Act 2011, among other things, prohibits cash transactions and mandates Suspicious Transaction Reports to be sent to the EFCC. While the Terrorism (Prevention) Act 2011, prevents acts of terrorism and by a later amendment in 2013, empowers all law enforcement agencies in Nigeria to fight terrorism and adopt measures to prevent terrorism in Nigeria.

Special Control Unit against Money Laundering (SCUML) Certificate is a vital tool for opening and operating a bank account, for many businesses and professionals in Nigeria. This is handled by several law enforcement agencies, regulators and stakeholders, including the Economic and Financial Crimes Commission (EFCC). Read more on this via; Legality of SCUML (EFCC) Certificate.

Call for Legal Awareness Articles in English or Pidgin Languages.

By the provisions of the Money Laundering (Prohibition) Act 2011, any Designated Non-Financial Institutions (DNFI) that is involved in cash transactions is to provide declaration of its activities to the Federal Ministry of Finance. By that law, Designated Non-Financial Institutions (DNFI) are dealers in Jewelry, cars and luxury goods, chartered accountants, audit firms, tax consultants, clearing and settlement companies, legal practitioners, hotels, casinos, supermarkets, or such other businesses as the Federal Ministry of Commerce or appropriate regulatory authorities may from time to time designate. Read more on this via; Persons That Must Obtain SCUML (EFCC) Certificate.

Hence, by the express provisions of the Money Laundering (Prohibition) Act, the federal law listed legal practitioners as professionals that need to obtain SCUML Certificate (EFCC Clearance) before running a bank account for their legal practice in Nigeria. This means that the EFCC and other concerned law enforcement agencies can access information about clients of legal practitioners through the bank accounts of legal practitioners, when legal practitioners obtain SCUML for their bank accounts. This will in turn aid the agency in curbing and prevent financial crimes that may involve lawyers and their clients.

However, the Evidence Act in Nigeria (a federal law that regulates the administration of evidence in courts) protects the communication between legal practitioners and their clients. Such communications are deemed to be privileged and to be made on the trust that they will not to be accessed or made available to a third party (like, the EFCC and other law enforcement agencies), except in special circumstances. Also, the communication between a legal practitioner and his client (the Client-Lawyer Relationship) is arguably part of the fundamental human rights of a client; “the Right to Private and Family Life”. Yes, the private communication of a client and his attorney should not be violated, except with an order of court. For more on this read; Lawyers No Longer Need SCUML (EFCC) Certificate.

The Nigerian Courts on the Money Laundering (Prohibition) Act 2011and the Lawyers:

Obviously, there is a clash of federal laws between the Money Laundering (Prohibition) Act 2011 and the Evidence Act, 2011. While, the EFCC relies on the Money Laundering (Prohibition) Act to lawfully supervise bank accounts of lawyers and to demand that lawyers use SCMUL for their bank accounts, Lawyers rely on the Evidence Act (and arguably the Constitution of Nigeria) to lawfully demand that the EFCC and all other persons stay away from their Client-Attorney Relationships and their bank accounts.

Call for Legal Awareness Articles in English or Pidgin Languages.

Until there is a legislative amendment of any of the concerned federal laws, both lawyers and the EFCC will not relent in their lawful crusades. In the meantime, the Judiciary has been approached severally by both parties (Lawyers and the Government/EFCC) to interpret the conflicting laws; the Money Laundering (Prohibition) Act 2011 and the Evidence Act 2011.

The first judicial attempt to resolve the clash was in the case filed by the Nigerian Bar Association against the Attorney General of the Federation and the Central Bank of Nigeria, at the Federal High Court, in the case the Registered Trustees of Nigerian Bar Association V. AGF & CBN (Suit No: HC/BS/173/2014). The Court upheld the argument of the Nigerian Bar Association that bank accounts of lawyers for their legal practice cannot be supervised, so as to avoid breaching the Client-Attorney relationship. Read more via; A Lawyer’s Bank Account is Exempted from EFCC, SCUML, NFIU and Police Registration/Clearance.

As expected, being unsatisfied with the judgment of the Federal High Court, the Attorney General of the Federation (AGF) appealed the judgment at the Court of Appeal in the case of CBN V. NBA & AGF (Appeal No: CA/A/202/2015). The Court of Appeal being the second most superior court, entertained the matter and ruled in favour of the Nigerian Bar Association. The Court of Appeal upheld the judgment of the Federal High Court, that the bank accounts of legal practitioners for their practice cannot be accessed by third parties, to avoid a violation of communications between clients and their lawyers. Well, as at the time of this publication, no person has challenged the said judgment of the Court of Appeal at the Supreme Court (even the statutory period for such appeal has elapsed). Hence, it is safe to conclude that all person in Nigeria have accepted the judgment of the Court of Appeal on the issue and that the judgment is the final on the issue for now.

Recently on 14 May 2021, in a different matter, the Court of Appeal had another opportunity to rule on the issue of whether lawyers are bound to obtain SCMUL and are to subject their bank accounts to the EFCC, in line with the Money Laundering (Prohibition) Act. This was in the case of the Federal Republic of Nigeria V. Chief Mike Ozekhome, SAN (Appeal No. CA/L/174/19). Still again, the Court of Appeal repeated itself by emphasizing its earlier position on the issue and stressed that lawyers are not bound by section 10 of the Money Laundering (Prohibition) Act. And as such, lawyers are not mandated to obtain SCMUL and have their banks accounts accessible by the EFCC and any other third party, so as to avoid breach any communication between a lawyer and his client. Again, the EFCC Lacks Power Over Lawyers Bank Accounts.

The Emergence of a New Federal Law; the Money Laundering (Prevention and Prohibition) Act 2022.

Just when it seemed the Nigerian courts had settled the issues of the SCMUL and the other agencies’ incursion on lawyer-attorney confidentiality, a new law that clearly listed legal practitioners and notaries among the Designated Non-Financial Institutions (DNFI) emerged. I don’t need to consult the powerful shrines of my ancestors to know that it was an intentional step to nullify the judiciary’s efforts to safeguard lawyer-attorney confidentiality in Nigeria.

Again, the fight against crime was going to infringe on the statutory rights of lawyers and, more importantly, our dear clients across the globe. It is so, because the legal community was divided on whether the pronouncements the courts on the issue still stand since the then law (the Money Laundering [Prohibition] Act 2011) that the courts interpreted was repealed (killed and buried) in 2022 by the emergence of a new law; the Money Laundering (Prevention and Prohibition) Act 2022. While many lawyers why arguing on the issue in the public space (outside the courts), Mr. Abu Arome (a legal practitioner) dragged his banker (Guaranty Trust Bank) and other key players to the Federal High Court over the restrictions placed on law firm’s bank accounts.

In the judgment of 19 July 2024, in Abu Arome V. CBN and Ors (FHC/ABJ/CS/25/2023) (Unreported), the Federal High Court (Justice Obiora Egwuatu) held that sections 6, 7, 8, 9, 11 and 30 of the Money Laundering (Prevention and Prohibition) Act 2022 as it purportedly applies to legal practitioners and notaries are unconstitutional, null and void. In the judgment, the court perpetually restrains the Central Bank of Nigeria (CBN) and the Economic and Financial Crimes Commission (EFCC) from taking any step to implement its circular referenced FPR/DIR/PUB/CIR/001/052 dated 20th June 2022 and the “Economic and Financial Crimes Commission (Anti-Money Laundering, Combating the Financing of Terrorism and Countering, Proliferation) Financing of Weapons of Mass Destruction for Designated Non-Financial Businesses and professions, and other related Matters) Regulation, 2022”. Again, the Nigerian court has come to the rescue of Nigerian lawyers and their clients across the world. I believe the same fate awaits any appeal that may arise from the matter.

Conclusion:

Nigeria is designed to be lawful nation, governed by laws and not by the wishes or dictates of any person. So, no matter how good an idea may be, such an idea will not bind Nigerians, until it is passed into law. And, when there is a gap in law, the Courts (the Judiciary) are prayed to interpret the laws and where necessary, the lawmakers (the Legislature) are lobbied to amend the laws. The Federal Government (the Executive) and its agencies (the EFCC, DSS, ICPC, Police and others) are to execute laws as made by the Legislature and as interpreted by the Judiciary.

Legal practitioners are not above any law in Nigeria, rather they have more laws to obey (professional codes and the Legal Practitioners’ Act, among others). Clients of legal practitioners are not above any law in Nigeria, both legal practitioners and their clients are not saints either. However, the communications between a lawyer and his client are golden and must be respected by all, except in special circumstances. The communication between client and lawyer includes; email, telephones, bank payments, cash exchanges and others. No person needs to supervise such communication, since there are made in trust and protected by law. Clients will not feel safe to engage lawyers to prosecute their cases and perform duties for on their behalf, where their communications with their lawyers are not protected. Such distrust will collapse the legal profession, close the courts and beget anarchy and the dislodgement of rule of law.

The growing financial crimes in Nigeria and the undeniable role of professionals (including lawyers) in aiding such crimes are in public domain. Yes, there are lawyers that are unethical and that will aid clients and persons in perpetrating crimes. The reports from the Legal Practitioners Disciplinary Committee are clear proofs of this assertion. Hence, the federal institution tasked to curb and prevent financial crimes (the EFCC) seriously desires to keep a tab on lawyers and their operations, in order to easily prevent and fish out unethical lawyers that collude with their clients to perpetrate economic and financial crimes. However, this desire seems jeopardized, since it will unduly and unlawfully expose and breach the communications that are protected under laws and the Client-Attorney Relationships.

However, the EFCC and other law enforcement agencies are not without some lawful options that will enable them stop and prevent financial crimes, especially ones where lawyers and their clients conspire. It only requires a better assessment of the Constitution of Nigeria, the Evidence Act, the Legal Practitioner’s Rules of Professional Conduct and a slight twitch of the operational strategy of the EFCC. At all times, let all persons (including, lawyers and their clients) that are involved in economic and financial crimes be found and be forced to face the law. After all, if crime takes over Nigeria, there will be no lawyers and courts for the legal profession.

References:

- Sections 5, 6, 7, 8, 9, 11 and 30 of the Money Laundering (Prevention and Prohibition) Act 2022

- Sections 1, 2, 5, 6, 10, 25 and 26 of the Money Laundering (Prohibition) Act 2011 (now repealed)

- Section 1, 40 and 41 of the Terrorism (Prevention) Act, 2011

- Section 1, 4, 14, 14 and 20 of the Terrorism (Prevention) (Amendment) Act, 2013

- Sections 192 and 195 of the Evidence Act

- Rule 19(1) of the Rules of Professional Conduct for Legal Practitioners 2007

- The Central Bank of Nigeria (Anti Money Laundering and Combating of Financing of Terrorism for Banks and Other Financial Institutions in Nigeria) Regulation 2013.

- The Nigeria Securities and Exchange Commission (SEC) and National Insurance Commission (NAICOM) AML/CFT Regulations for their respective operators.

- Regulations 1, 2, 4, 33 and 34 of the Federal Ministry of Industry, Trade and Investment (Designation of Non-Financial Institutions and Other Related Matters) Regulations, 2013

- Regulations 1, 2, 3, and 4 of the Federal Ministry of Industry, Trade and Investment (Designation of Non-Financial Institutions and Other Related Matters) Regulations, 2016

- The Terrorism Prevention (Freezing of International Terrorists Funds and Other Related Measures) Regulations, 2013.

- The National (Money Laundering & Terrorist Financing) Risk Assessment Forum, “NIGERIA ANTI MONEY LAUNDERING AND COMBATING THE FINANCING OF TERRORISM NATIONAL STRATEGY 2018 – 2020” (SCUML, 2018) <https://www.scuml.org/wp-content/uploads/2019/08/NIGERIA-AMLCFT-NATIONAL-STARTEGY-DOCUMENT.pdf> accessed 16 July 2021

- The judgement of the Federal High Court in the case of Abu Arome V. CBN and Ors (FHC/ABJ/CS/25/2023)

- The judgment of the Court of Appeal in the case of CBN V. NBA & AGF (Appeal No: CA/A/202/2015).

- The judgment of the Court of Appeal in the case of the Federal Republic of Nigeria V. Chief Mike Ozekhome, SAN (Appeal No. CA/L/174/19)

- The judgement of the Federal High Court in the case of Registered Trustees of Nigerian Bar Association V. AGF & CBN (Suit No: FHC/BS/173/2014).

- The Nation, “Court Restraints Fed Govt, CBN SCUML from Enforcing Money Laundering Act on Legal Practitioners” (The Nation, 23 December 2014) <https://thenationonlineng.net/court-restraints-fed-govt-cbn-scuml-enforcing-money-laundering-act-legal-practitioners/> accessed 16 July 2021

- Toyin Nwiido, Interview with Ogwemoh Sylva, SAN (Commercial Law Development Services, July 2018) <http://www.clds-ng.com/wp-content/uploads/2018/07/CLDS-Newsletter_July-2018_b.pdf> accessed 16 July 2021

- Davidson Iriekpen, “Appeal Court Voids EFCC’s Seizure of Ozekhome’s Professional Fees” (ThisDay, 25 May 2021) <https://www.thisdaylive.com/index.php/2021/05/25/appeal-court-voids-efccs-seizure-of-ozekhomes-professional-fees/> accessed 16 July 2021.

- Onyekachi Umah, “Legality of the “EFCC Order” on Bank Employees Declaration of Assets” (ThisDay, 6 April 2021) <https://www.thisdaylive.com/index.php/2021/04/06/legality-of-the-efcc-order-on-bank-employees-declaration-of-assets/amp/> accessed 7 April 2021.

- Onyekachi Umah, “The Minimum Financial Threshold for EFCC Cases.” (LearnNigerianLaws.com, 1 September 2020) <https://sabilaw.org/the-minimum-financial-threshold-for-efcc-cases/> accessed 16 July 2021

- Onyekachi Umah, “The Central Bank of Nigeria Notices on Cryptocurrencies; a Ban or a Banger?” (LearnNigerianLaws.com, 9 February 2021) <https://sabilaw.org/the-central-bank-of-nigeria-notices-on-cryptocurrencies-a-ban-or-a-banger/> accessed 17 February 2021

- Onyekachi Umah, “Unlawfulness of the EFCC Order on Bankers Declaration of Assets” (LearnNigerianLaws.com, 8 April 2021) <https://sabilaw.org/unlawfulness-of-the-efcc-order-on-bankers-declaration-of-assets/> accessed 12 April 2021

- Onyekachi Umah, “Debunking Myths Relating to Bankers Declaration of Assets Law” (LearnNigerianLaws.com, 12 April 2021) <https://sabilaw.org/debunking-myths-relating-to-bankers-declaration-of-assets-law/> accessed 20 April 2021

- Onyekachi Umah, “Nigerians That Are Prohibited From Having Foreign Bank Accounts” (LearnNigerianLaws.com, 25 November 2020) <https://sabilaw.org/nigerians-that-are-prohibited-from-having-foreign-bank-accounts/> accessed 16 July 2021

- Onyekachi Umah, “The Supreme Court Has Warned Efcc And Police Against Recovering Debts And Investigating Disputes From Civil Transactions.” (LearnNigerianLaws.com, 26 October 2019) <https://sabilaw.org/the-supreme-court-has-warned-efcc-and-police-against-recovering-debts-and-investigating-disputes-from-civil-transactions-daily-law-tips-tip-444-by-onyekachi-umah-esq-llm-aciarb-uk/> accessed 16 July 2021

- Photo credit: Sentinel

Sabi Law Projects:

#SabiLaw

#DailyLawTips

#SabiBusinessLaw

#SabiElectionLaws

#SabiHumanRights

#SabiLawOnTheBeatFm

#SabiLawLectureSeries

#CriminalJusticeMonday

#SabiLawVideoChallenge

Speak with the writer, ask questions or make inquiries on this topic or any other via onyekachi.umah@gmail.com, info@LearnNigerianLaws.com or +2348037665878 (whatsapp). To receive free Daily Law Tips, join our free WhatsApp group via https://chat.whatsapp.com/L7h4f1exItZ38FeuhXG4WNor Telegram group, via the below link: https://t.me/LearnNigerianLaws

To keep up to date on all free legal awareness projects of Sabi Law Foundation, follow us via

Facebook Page:@LearnNigerianLaws,

Instagram:@LearnNigerianLaws,

Twitter: @LearnNigeriaLaw,

YouTube: Learn Nigerian Laws,

WhatsApp Groups via (https://chat.whatsapp.com/L7h4f1exItZ38FeuhXG4WN),

Telegram Group: (https://t.me/LearnNigerianLaws),

Facebook group: (https://www.facebook.com/groups/129824937650907/?ref=share)

or visit our website: (www.LearnNigerianLaws.com )

Please share this publication for free till it gets to those that need it most. Save a Nigerian today! NOTE: Sharing, modifying or publishing this publication without giving credit to the author or Sabi Law Foundation is a criminal breach of copyright and will be prosecuted. This publication is the writer’s view not a legal advice and does not create any form of relationship. You may reach the writer for more information.

This publication is powered by www.LearnNigerianLaws.com {A Free Law Awareness Program of Sabi Law Foundation, supported by the law firm of Bezaleel Chambers International (BCI).} Sabi Law Foundation is a Not-For-Profit and Non-Governmental Legal Awareness Organization based in Nigeria. For sponsorship and partnership, contact: sponsorship@learnnigerianlaws.com, sabilaw.ng@gmail.com or +234 903 913 1200.

4 Responses

I invested in platforms MT4 MT5 and Coonska

they refuse to let me withdraw my money

I need an EFCC lawyer