Radio, Television And Communication Mast License Fee By Local Governments In Nigeria. Daily Law Tips (Tip 519) by Onyekachi Umah, Esq., LLM. ACIArb(UK)

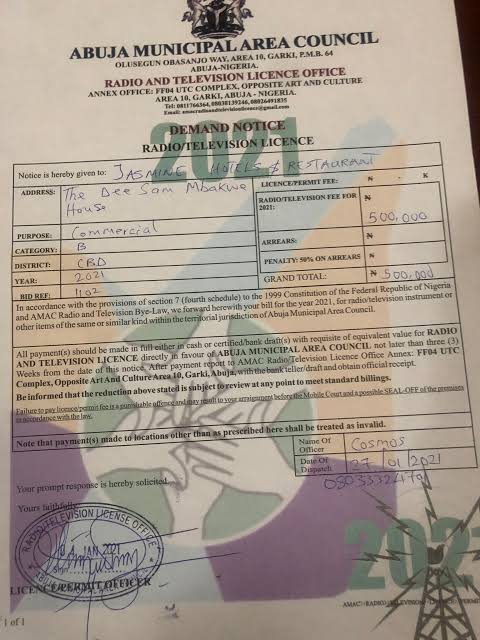

Radio, Television and Communication license is an annual levy/license fee assessable and collectable by local governments across Nigeria from any business or individual that owns or controls any radio or television instrument or any item of similar kind. Rightly or wrongly, with the recent boom in technology, local governments have extended their demands to owners/operators of communication mast/GSM Service Providers (arguably, telecommunication mast is not part of the duties/powers of Local Governments under the constitution of Nigeria).

Although, the bye-law of Karu Local Government of Nasarawa State is used here, the principles examined here also applies to other local governments across Nigeria. Annual payment of Radio, Television and Communication license is expected from both corporate bodies and human beings, whether such devices are used for private or commercial purposes. It is a criminal offence to default in payment and it is punishable with extra 50% of the initial fee as well as 3 months imprisonment for individuals and less than one month closure of business premises for companies. Appointed officers of local governments can during working hours of working days access any premises (whether residential or commercial) for the purpose of inspection. Stopping/limiting such officers is an offence punishable as earlier stated above.

Magistrate Courts of any grade have jurisdiction over cases relating to Radio/Television and Communication licences in local governments. The annual maximum fee for this license is N1, 000, 000.00 for business under category “A” which covers head-offices of multi-national companies, banks and oil companies while the annual minimum fee of N3,500 for individuals living in self-contain apartments. Below is the full list of annual license fees:

1. Category “A” pays N1, 000, 000.00 and includes; Headquarters of Organization, including Multi-National Companies, Banks (Merchant banks inclusive), Financial Institutions, Oil Companies and other Corporate Bodies

2. Category “B” pays N800, 000.00 and includes; Branches of multi—national companies, Banks, insurance and Financial Institutions including Merchant Banks, Textiles and Fabric Companies. Equipment Leasing Companies, Motor Factories, Engineering Companies, Packaging Companies, Automobile & Motor Factories, Security, Technical Equipment and Machinery Companies, Pharmaceutical Companies, Investment Companies, Architectural Consultancy Companies, Computer Service Generally, Manufacturing Companies and High Class Hotels, and other similar kinds of entities.

3. Category “C” pays for Large N50, 000.00, Medium N50,000.00 and Small N50, 000.00. This includes; Airline/Travel Agencies, Courier Services Companies, Petrol/Filling Stations, Haulage and light storage Companies, Telecommunication Companies, Marine Ocean Graphic arid Inter Marine Companies, Agro Allied Companies, Manufacturing Companies, General Supermarkets, Boutiques, Gas Laboratory and Hospital Equipment Companies, Dry Cleaning and Laundry Services, Fast food Centers, Public Re1ation/Photography Companies, Photocopying and Duplicating Centers , and other similar entities.

4. Category “D” pays for Duplex N5,000.00, Flat –N5, 000.00, Bungalow – N5000.00 and Self-Contain Apartment—N3, 500.00. This includes an Individual: Residential Premises.

5. Category “E” pays N1, 000, 000.00 and includes Communication Mast (GSM Providers).

Note that, just like, the Federal and State governments, the law does not allow Local Governments to delegate these powers or to engage and use third parties, private companies, citizens, louts and armed officers to assess, collect or recover its taxes, levies and fines.

References:

1. Section 7 and Paragraph 1(b) of the Fourth Schedule to the Constitution of the Federal Republic of Nigeria, 1999.

2. Sections 2 and 5 as well as the Schedule to the Taxes and Levies (Approved List for Collection) Act, 1998 and the Schedule to the Taxes and Levies (Approved List for Collection) Act, (Amendment) Order 2015.

3. Sections 1 to 9 of the Radio, Television License and Communication Mast Bye-Law (No. 10) 2018, Karu Local Government Bye-Law 2018

#SabiLaw

#DailyLawTips

#SabiBusinessLaw

#SabiElectionLaws

#SabiHumanRights

#SabiLawOnBeatFm

#SabiLawLectureSeries

#CriminalJusticeMonday

#SabiLawVideoChallenge

Feel free to reach the author, ask questions or make inquiries on this topic or any other legal issues via onyekachi.umah@gmail.com or +2348037665878.

****************************************************************************************

This work is published under the free legal awareness project of Sabi Law Foundation (www.SabiLaw.org) funded by the law firm of Bezaleel Chambers International (www.BezaleelChambers.com). The writer was not paid or charged any publishing fee. You too can support the legal awareness projects and programs of Sabi Law Foundation by donating to us. Donate here and get our unique appreciation certificate or memento.

DISCLAIMER:

This publication is not a piece of legal advice. The opinion expressed in this publication is that of the author(s) and not necessarily the opinion of our organisation, staff and partners.

PROJECTS:

🛒 Take short courses, get samples/precedents and learn your rights at www.SabiLaw.org

🎯 Publish your legal articles for FREE by sending to: eve@sabilaw.org

🎁 Receive our free Daily Law Tips & other publications via our website and social media accounts or join our free whatsapp group: Daily Law Tips Group 6

KEEP IN TOUCH:

Get updates on all the free legal awareness projects of Sabi Law (#SabiLaw) and its partners, via:

YouTube: SabiLaw

Twitter: @Sabi_Law

Facebook page: SabiLaw

Instagram: @SabiLaw.org_

WhatsApp Group: Free Daily Law Tips Group 6

Telegram Group: Free Daily Law Tips Group

Facebook group: SabiLaw

Email: lisa@sabilaw.org

Website: www.SabiLaw.org

ABOUT US & OUR PARTNERS:

This publication is the initiative of the Sabi Law Foundation (www.SabiLaw.org) funded by the law firm of Bezaleel Chambers International (www.BezaleelChambers.com). Sabi Law Foundation is a Not-For-Profit and Non-Governmental Legal Awareness Organization based in Nigeria. It is the first of its kind and has been promoting free legal awareness since 2010.

DONATION & SPONSORSHIP:

As a registered not-for-profit and non-governmental organisation, Sabi Law Foundation relies on donations and sponsorships to promote free legal awareness across Nigeria and the world. With a vast followership across the globe, your donations will assist us to increase legal awareness, improve access to justice, reduce common legal disputes and crimes in Nigeria. Make your donations to us here or contact us for sponsorship and partnership, via: lisa@SabiLaw.org or +234 903 913 1200.

**********************************************************************************

4 Responses